projectfinance

How to Understand Option Prices SIMPLY

1 year ago - 11:04

Khan Academy

Introduction to the Black-Scholes formula | Finance & Capital Markets | Khan Academy

11 years ago - 10:24

Sky View Trading

Options Trading: Understanding Option Prices

10 years ago - 7:31

Option Alpha

Options Pricing & The Greeks - Options Mechanics - Option Pricing

9 years ago - 31:33

The Plain Bagel

The Greeks - Stock Option Price Factors Explained

3 years ago - 10:47

PrepNuggets

CFA Level I Derivatives - Binomial Model for Pricing Options

5 years ago - 5:31

Sky View Trading

Understanding Option Prices - COMPLETE BEGINNERS GUIDE (Part 3)

3 years ago - 32:02

Intrinio

How the Black-Scholes Options Pricing Model 💲🎯 Works

1 year ago - 4:55

Learning0to1

Black Scholes Formula explained simply

2 years ago - 3:40

TOLU SULE ACADEMY

OPTION PRICING: Call & Put Option ( ICAN - Strategic Financial Management SFM)

1 year ago - 14:47

Matt Brigida

FIN 376: Binomial Option Pricing and Delta Hedging

10 years ago - 17:14

TOLU SULE ACADEMY

OPTION PRICING: The Greeks, Delta Hedging, Real Options. (ICAN SFM)

1 year ago - 35:37

OptionsPlay

How Option Pricing Works: A Complete Beginner's Guide

6 months ago - 1:17:04

FinRow Academy

Derivative Valuation - Option Pricing Model (409a valuation) -The first ever video on OPM model.

2 years ago - 41:40

Kevin Bracker

Black-Scholes Option Pricing Model -- Intro and Call Example

13 years ago - 13:39

TradingBlockTV

Option Trade: Ideal Strike Price Width

4 months ago - 0:56

Michael Shear

Theta Decay Explained: Options Trading Basics

4 months ago - 0:22

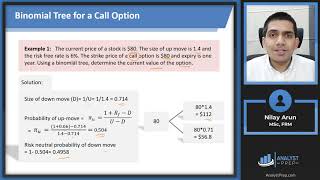

AnalystPrep

Binomial Option Pricing Model (Calculations for CFA® and FRM® Exams)

4 years ago - 21:40

Coder Trader

Why The Heston Model BEATS Black Scholes in 2025?

1 month ago - 0:39

QuantPy

Monte Carlo Simulation for Option Pricing with Python (Basic Ideas Explained)

3 years ago - 30:09

The Elite Prep

Quant Fundamentals: Option Pricing II

1 year ago - 22:14

Money Mastery Lab

Stock options - Managing risk or speculating? | Option strategies | Options trading | Risk mgmt.

1 year ago - 0:13

Sky View Trading

Understanding Option Pricing - Intrinsic and Extrinsic Value

1 year ago - 0:58

Gresham College

Option Pricing Theory Explained - Raghavendra Rau

1 year ago - 1:07:32

V.P FINANCIALS

Option Buyers Strike Price कैसे Select करे? | VP Financials

2 years ago - 1:00

Jason Mosley

Download The Complete Guide to Option Pricing Formulas PDF

9 years ago - 0:31