Quant Next

@quantnext4773 subscribers

Quant Next

The Black-Scholes Model

2 years ago - 5:07

Quant Next

Volatility Surface Modelling: An Introduction

1 year ago - 5:55

Quant Next

Risk Neutral Density: The Breeden-Litzenberger Formula

1 year ago - 3:50

Quant Next

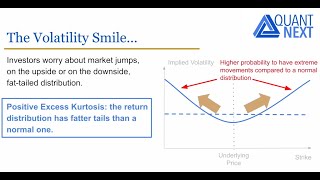

The Volatility Smile and Skew

2 years ago - 4:31

Quant Next

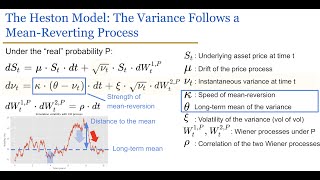

The Heston Model (Part I)

2 years ago - 7:22

Quant Next

Introduction to Option Greeks and Risk Management

2 years ago - 5:09

Quant Next

The SABR Model Part I: an Introduction

1 year ago - 5:11

Quant Next

Options, Pricing and Risk Management Part III - Course Overview

1 year ago - 3:41

Quant Next

The Option Greek Delta Explained

2 years ago - 5:15

Quant Next

Greeks and Risk Management of Exotic Options: An Introduction

1 year ago - 4:25

Quant Next

Volatility Surface Parameterization: the SVI Model - Course Overview

1 year ago - 2:54

Quant Next

Credit Risk: An Introduction

1 year ago - 8:42

Quant Next

Credit Risk Modelling: an Introduction to Reduced-Form Models

9 months ago - 4:25

Quant Next

Introduction to Derivatives - Barrier Options

2 years ago - 2:43

Quant Next

Artificial Neural Network for Option Pricing with Python Code

1 year ago - 8:59

Quant Next

Replication and Risk Management of Exotic Options: Overview of the Course

1 year ago - 1:06

Quant Next

Exotic Options - Part I

2 years ago - 6:42

Quant Next

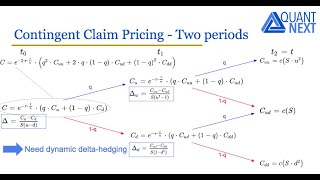

The Cox-Ross-Rubinstein Binomial Option Pricing Model

2 years ago - 6:22

Quant Next

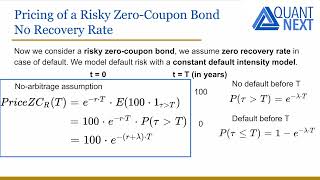

Credit Risk Modelling: Pricing of a Defaultable Bond with Reduced-Form Models Part I

8 months ago - 4:17

Quant Next

Credit Risk Modelling: The Probability of Default

1 year ago - 7:54

Quant Next

Introduction to Stochastic Calculus

2 years ago - 7:03

Quant Next

Credit Risk Modelling: Pricing of a Defaultable Bond with Reduced-Form Models Part IV

3 months ago - 6:06

Quant Next

Options, Pricing and Risk Management Part II: Overview of the Course

1 year ago - 2:13

Quant Next

The SABR Model: Course Overview

1 year ago - 2:15

Quant Next

Exotic Options - Part II

2 years ago - 6:32

Quant Next

The Black-Scholes Formula Explained

2 years ago - 5:52

Quant Next

Introduction to Finite Difference Methods for Option Pricing

1 year ago - 5:48

Quant Next

American Option Pricing with Binomial Tree

1 year ago - 5:13

Quant Next

Implied Volatility Calculation with Newton-Raphson Algorithm

2 years ago - 5:13

Quant Next

Credit Risk Modelling: Pricing of a Defaultable Bond with Reduced Form Models Part II

6 months ago - 4:17

Quant Next

The Heston Model (Part II)

2 years ago - 10:22

PIMCO U.S.

Quant’s Next Frontier: Harness New Opportunities in Complex Markets

2 years ago - 2:44

DC Perspective

Quant next move 🚀 #quant #qnt #trading #trade

2 years ago - 0:08

Quant Next

Finite Difference Methods for Option Pricing: Overview of the Course

1 year ago - 1:23

PIMCO Hong Kong

Quant’s Next Frontier: Harness New Opportunities in Complex Markets

2 years ago - 2:44