Quant Next

Introduction to Stochastic Volatility Models

2 years ago - 5:55

QuantPy

Stochastic Volatility Models used in Quantitative Finance

3 years ago - 7:40

C-RAM

How do I Test whether a Time Series has Stochastic Volatility (Heteroscedasticity)?

3 years ago - 3:42

MathFinance

Local Stochastic Volatility pricing of FX derivatives

11 years ago - 8:20

quantpie

Derivation of Heston Stochastic Volatility Model PDE

5 years ago - 29:03

C-RAM

How do I Test whether a Time Series has Stochastic Volatility (Heteroscedasticity)?

5 years ago - 3:24

Martin Forde

Stochastic volatility toolpack derivatives SABR Heston Levy Credits models Implied Volatility smile

12 years ago - 0:21

QuantPy

Simulating the Heston Model with Python | Stochastic Volatility Modelling

3 years ago - 12:25

Filippo Perugini

RxScala: Heston stochastic volatility model

10 years ago - 1:17

C-RAM

Test #2 for whether a Time Series has Stochastic Volatility: LM Test

3 years ago - 4:15

Kidbrooke Advisory

Animation of Stochastic Volatility Jump Diffusion (SVJD)

8 years ago - 0:07

Quants Hub & BTRM

Pricing Options via Fourier Inversion & Simulation of Stochastic Volatility Models - Roger Lord

11 years ago - 13:48

随机波动StochasticVolatility

随机波动StochasticVolatility是一档由三位女性媒体人发起的一档泛文化类播客。这是我们的唯一youtube频道。

@stochasticvolatility4839 subscribers

Quants Hub & BTRM

Pricing Options via Fourier Inversion & Simulation of Stochastic Volatility Models - Session Sample

11 years ago - 6:14

C-RAM

Lecture 5.2: Risk Management: Stochastic Volatility Model and Estimation via Kalman Filter and MLE

9 days ago - 1:25:09

numerixanalytics

Capturing the Dynamics of Stochastic Volatility | Numerix Video Blog

11 years ago - 4:41

C-RAM

SVM_V1: Univariate Log-Normal Stochastic Volatility Model

5 years ago - 4:41

Hoang Nguyen

A dynamic leverage stochastic volatility model

3 years ago - 3:55

Audiopedia

Stochastic volatility

9 years ago - 9:12

QuantPy

Monte Carlo Simulation with Multiple Factors | European spread options with stochastic volatility

3 years ago - 13:37

WikiAudio

Stochastic volatility

9 years ago - 8:26

quantpie

Local vs Stochastic vs Implied Volatilities

5 years ago - 34:34

C-RAM

Test #2 for whether a Time Series has Stochastic Volatility: LM Test

5 years ago - 4:01

caltech

8 3 Stochastic Volatility Part 3

4 years ago - 9:31

Virtual Derivatives

Yannick Dillschneider -- GMM Estimation of Stochastic Volatility Models

4 years ago - 41:57

Exponential Science

CAAW - Regime-based Implied Stochastic Volatility Model for Crypto Option Pricing

2 years ago - 21:38

Scuola Normale Superiore

Giacomo Bormetti, Evaluation and pricing of risk under stochastic volatility - July, 10 2013

11 years ago - 32:58

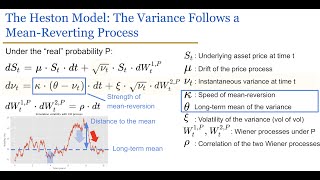

Quant Next

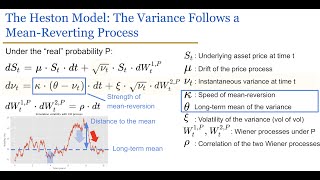

The Heston Model (Part I)

2 years ago - 7:22

QuantPy

Lookback Call Options with Stochastic Volatility

3 years ago - 23:04

Justus S

MATLAB App - Stochastic Volatility Option Pricing

9 years ago - 1:06

Quants Hub & BTRM

New Stochastic Volatility Models - Jörg Kienitz - Thursday 14 May 2020

5 years ago - 1:16:14

caltech

8 1 Stochastic Volatility Part 1

4 years ago - 11:39

Artur Sepp

Review of paper "Log-normal Stochastic Volatility Model with Quadratic Drift" and its Github project

2 years ago - 42:38