Quant Next

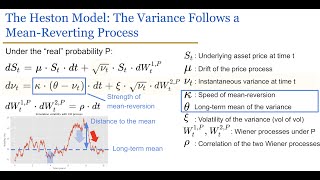

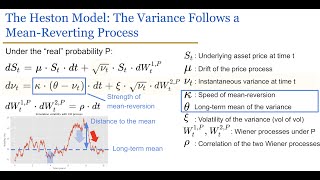

The Heston Model (Part I)

2 years ago - 7:22

Roman Paolucci

Heston Stochastic Volatility Model and Fast Fourier Transforms

5 months ago - 37:11

QuantPy

Heston Model Calibration in the "Real" World with Python - S&P500 Index Options

3 years ago - 27:18

QuantPy

Simulating the Heston Model with Python | Stochastic Volatility Modelling

3 years ago - 12:25

NEDL

Heston model explained: stochastic volatility (Excel)

3 years ago - 14:55

Quant Next

The Heston Model for Option Pricing: Course Overview

1 year ago - 2:02

Computations in Finance

Computational Finance: Lecture 10/14 (Monte Carlo Simulation of the Heston Model)

4 years ago - 1:33:29

quantpie

Derivation of Heston Stochastic Volatility Model PDE

6 years ago - 29:03

Quant Next

The Heston Model (Part II)

2 years ago - 10:22

Valentin Garcia

Explore the Heston Model by Pulte Homes in Riverwood

1 year ago - 5:04

QuantPy

Stochastic Volatility Models used in Quantitative Finance

3 years ago - 7:40

Yulia Olivo, Realtor

New Home Tour | The Heston Model | Pulte Homes | New Construction in Riverview FL.

11 months ago - 4:42

Roman Paolucci

Heston Model Calibration: Deriving Risk-Neutral Dynamics

2 months ago - 0:22

Roman Paolucci

Heston Model Implied Volatility Surface

6 months ago - 0:58

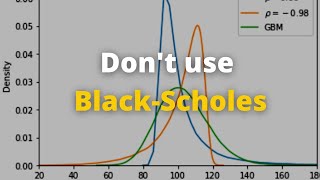

Coder Trader

Why The Heston Model BEATS Black Scholes in 2025?

9 months ago - 0:39

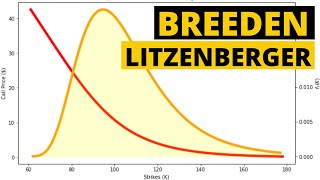

Computations in Finance

Can you interpret the Heston model parameters and their impact on the volatility surface?

2 years ago - 10:43

JustWriteTheCode

How to Price a CHOOSER OPTION under the HESTON MODEL (with Monte Carlo Simulation)

2 years ago - 13:25

SNSL Workshop

Simon Breneis, Markovian approximations for rough volatility models

3 years ago - 14:52

Quant Next

Introduction to Stochastic Volatility Models

2 years ago - 5:55

MoQuant

Rough Heston Model in C++

2 months ago - 49:14

BP International

Quantifying Uncertainty: Potential Medical Applications of the Heston Model of Financial Stochastic

2 years ago - 2:17

FELT Labs

Using Heston Model to Simulate Stock Prices

2 years ago - 8:33

JustWriteTheCode

Trading Options Risk-Free with HESTON MODEL in Python

3 years ago - 11:46

iziRisk in English

23 Heston Stochastic Volatility When Volatility Itself Is Volatile

3 months ago - 2:09

Filippo Perugini

RxScala: Heston stochastic volatility model

11 years ago - 1:17

QuantPy

The Magic Formula for Trading Options Risk Free

3 years ago - 22:16

QuantPy

Monte Carlo Simulation with Multiple Factors | European spread options with stochastic volatility

3 years ago - 13:37

vlogize

Resolving the Boost assertion failed: px != 0 Error in QuantLib's Heston Model Using Python

4 months ago - 2:12

Roman Paolucci

Deep Learning (Rough) Volatility Paper Review

3 years ago - 15:37

![Heston Model UNLOCKED: The Superior Way to Forecast Stock Prices (Stochastic Volatility) [Part 2]](/vi/eWx3IoRDxrc/mqdefault.jpg)

MoQuant

Heston Model UNLOCKED: The Superior Way to Forecast Stock Prices (Stochastic Volatility) [Part 2]

1 year ago - 14:52

LSE Statistics

Pricing and Hedging in rough volatility models by Antoine Jacquier

7 years ago - 1:05:48

Quants Hub & BTRM

ADI Schemes for Pricing Options under the Heston model - Karel in't Hout

11 years ago - 4:15

Ol Sela

Quant Finance : Pricing European Options under a New Two-Factor Heston Model with Regime Switching

3 months ago - 7:13

Computations in Finance

How to calibrate a pricing model? How to choose the objective function?

2 years ago - 13:20

![Heston Model UNLOCKED: The Superior Way to Forecast Stock Prices (Stochastic Volatility) [Part 2]](/vi/eWx3IoRDxrc/mqdefault.jpg)